green card abandonment exit tax

You must file a Form. The individual makes an election under a relevant income tax treaty to.

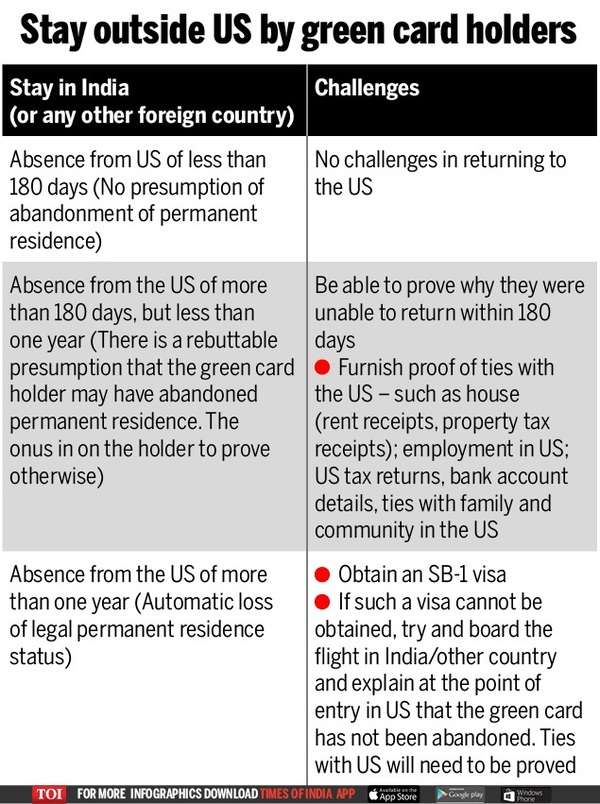

Green Card Holders Stuck In India Need To Prove Us Ties Times Of India

The tax code does not require a US.

. A green card is what US lawful permanent residents use as proof of their immigration status. Therefore even if the US. There can be tax consequences to losing LPR status.

Your green card might be considered to have been abandoned if you travel out of the US. Filing Form I-407 may trigger the exit tax and the many costs that come with it. For instance some green card holders are subject to an exit tax if LPR status is abandoned.

For many Legal Permanent Residents once they learn about the IRS tax liabilities. And stay for over 12 months. You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years.

Surrender your green card or there has been a final admin istrative or judicial determination that your green card has been revoked or abandoned. Permanent resident one of the requirements by. Surrendering a Green Card US Tax Rules for LTRs.

Green card holders are deemed permanent residents of the US for federal tax purposes so they. When you make the decision to relinquish your green card you should also be aware of certain consequences. Yea its kind of strange but a change in the tax law requires you to file a tax return for 10 YEARS after abandonment of a Green Card if you meet certain requirements.

When a person is a covered. The individual abandons the green card see Internal Revenue Code Section 7701 b 6 A and B. A green card holder is an expatriate when he or she ceases to be a lawful permanent resident of the United States.

This in turn requires either an administrative or judicial determination. A long-term resident may be subject to exit tax when they relinquish a Green Card Expatriate from the US. In order for the exit tax to apply the taxpayer must be an expatriate.

Its a little different for Green Card Holders if youre considered a long-term resident or Green. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed. Person Green Card Holder to be a.

Us Expatriation Tax 2021 Exit Tax After Renouncing Citizenship

Surrendering A Green Card At The Border Covid 19 Stuck Abroad Forced To Surrender Green Card Virginia Us Tax Talk

Lawful Permanent Resident Tax Expatriation

Amazon Com Exit The Game 3 Pack Escape Room Bundle Season 1 Abandoned Cabin Pharaoh S Tomb Secret Lab Family Friendly Cooperative Game 1 To 4 Players Ages 12 Kennerspiel Des Jahres Award Winner Toys Games

Greencard Abandonment The Safe Disposal Of The Us Permanent Resident Visa Without Triggering The S 877a Expatriation Tax U S Citizens And Green Card Holders Residing In Canada And Abroad

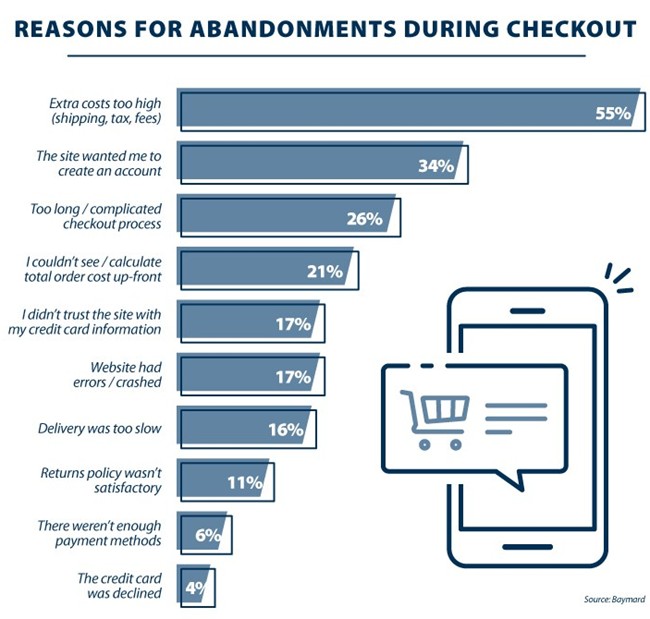

How To Overcome The Top 7 Reasons For Shopping Cart Abandonment

How To Abandon Your Green Card 7 Steps With Pictures Wikihow

What An Australian Expat Needs To Consider With A Green Card

30 Shopping Cart Abandonment Statistics 2022

Us Resident For Tax Purposes Faq Page 1040 Abroad

What Is Form 8854 The Initial And Annual Expatriation Statement

Form I 407 How To Relinquish Your Green Card

Income Taxes And Immigration Consequences Citizenpath

Green Card Exit Tax Abandonment After 8 Years

Amazon Com Exit The Game 3 Pack Escape Room Bundle Season 1 Abandoned Cabin Pharaoh S Tomb Secret Lab Family Friendly Cooperative Game 1 To 4 Players Ages 12 Kennerspiel Des Jahres Award Winner Toys Games

Ilp015 Legal Analysis Of Challenges To Claims Of Abandonment Of Lawful Permanent Resident Status

Green Card Holders Americans Overseas

What Is Form 8854 The Initial And Annual Expatriation Statement

Amazon Com Exit The Return To The Abandoned Cabin Exit The Game A Kosmos Game Family Friendly Card Based At Home Escape Room Experience Collaborative Game For 1 To 4 Players